Road Trips Are a Driver of Tourism

Working with Longwoods International, Miles Partnership produces the industry’s leading research on road trip travel in the U.S. Each year, we research and analyze the trends, challenges and opportunities of road trips in the U.S.

See our U.S. Road Trips & EV Travel Research Summary and the detailed research slide sets here

Road trips remain central to American travel. 91% of travelers have trips planned within the next 6 months, and 43% of travelers plan to take a road trip this fall.

The 2025 edition of our research highlights that road trips have grown to a $67 billion segment of the tourism industry in total spending, up 28% from 2019. This is slightly above the rate of inflation and highlights road trips’ enduring appeal among Americans. This appeal will likely increase in the year ahead with the centenary of the iconic Route 66, as well as economic uncertainty prompting more travelers to consider road trips as an affordable travel alternative.

The Road Trip Hot Spots

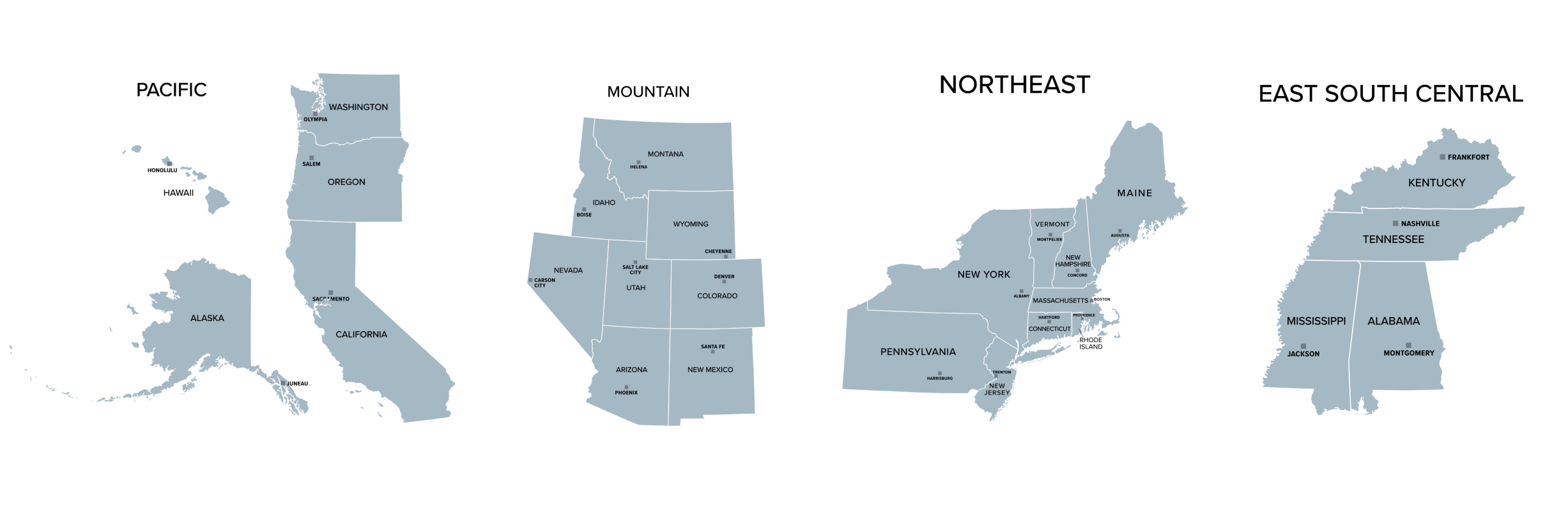

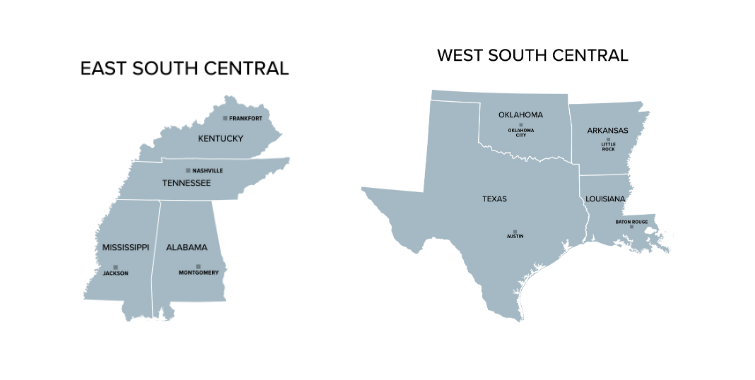

The importance of road trips in the tourism economy varies across the U.S.